Gross salary is a term that often comes up in job offers, contracts, and pay slips, but not everyone fully understands what it means. It represents the total amount of money an employee earns before any deductions, such as taxes or benefits, are taken out. This figure serves as a cornerstone for understanding one’s financial standing and is critical for proper financial planning. By getting a clear picture of gross salary, individuals can make better decisions about their budgets, savings, and career goals. Let’s break it down and explore how you can calculate it.

Understanding Gross Salary

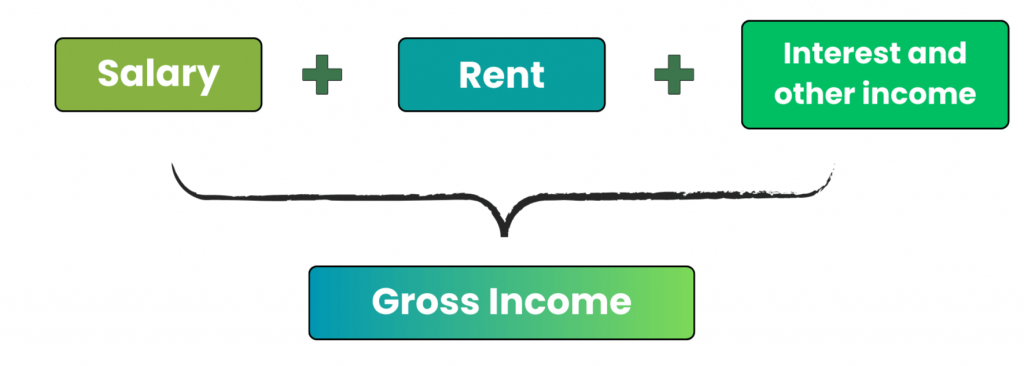

Gross salary is the total compensation agreed upon between an employer and an employee. It includes the basic pay for the job as well as any additional earnings such as bonuses, commissions, and allowances. This amount represents the full financial package provided for your work, serving as a benchmark for your earnings.

For instance, if your job offer states a gross annual salary of £50,000, this means you’ll earn that total amount in a year before deductions like income tax or pension contributions. Gross salary is the figure that employers often advertise in job postings because it gives a comprehensive picture of total earnings. However, it’s important to note that gross salary is not the same as net salary, which reflects what you actually take home.

Understanding gross salary helps in comparing job offers, setting financial expectations, and evaluating your long-term career goals. Without clarity on this concept, you might find it challenging to make informed decisions about your personal and professional life.

Components of Gross Salary

Gross salary comprises various components that together form your total earnings before deductions. The most prominent part is the basic pay, which is the fixed amount agreed upon for fulfilling your job duties. In addition to this, employers often include performance-based bonuses, which act as rewards for achieving specific targets or milestones. Sales-based roles frequently incorporate commissions, which are calculated as a percentage of sales made.

Allowances also play a significant role in determining gross salary. These may include stipends for housing, travel, or meals, depending on your employer’s policies. For instance, a housing allowance might be provided to cover a portion of your rent, while a travel allowance could offset commuting costs. If you work extra hours, overtime pay—often calculated at a premium rate—adds to your gross salary as well.

By understanding these components, you can better appreciate the value of your compensation package and identify opportunities to maximize your earnings.

How to Calculate Gross Salary

Calculating gross salary involves aggregating all fixed and variable income components. Let’s dive into the details:

Step 1: Start with the Basic Salary

Begin by identifying your annual base salary. This is the foundational figure specified in your employment contract. For example, if your agreed base salary is £48,000, this serves as the starting point for your calculation.

Step 2: Add Bonuses and Incentives

Include additional income such as performance bonuses, retention bonuses, or commissions earned through sales. If you are eligible for a £5,000 annual performance bonus and a £2,000 sales commission, add these figures to your base salary.

Running Total: £48,000 (base salary) + £5,000 (bonus) + £2,000 (commission) = £55,000.

Step 3: Factor in Overtime Pay

For employees who work beyond their standard hours, overtime pay significantly contributes to gross salary. Overtime rates often exceed standard hourly wages. For example, if you work 10 extra hours a month at an overtime rate of £20/hour, calculate your annual overtime earnings as follows:

10 hours/month × 12 months × £20/hour = £2,400.

Add this to your running total: £55,000 + £2,400 = £57,400.

Step 4: Include Allowances

Consider any employer-provided allowances, such as travel, housing, or meal stipends. If your employer offers a £2,000 annual travel allowance and a £1,500 housing allowance, these amounts are added to the total.

Updated Total: £57,400 + £2,000 (travel allowance) + £1,500 (housing allowance) = £60,900.

Step 5: Verify with Official Guidelines

Consult resources like HM Revenue & Customs (HMRC) in the UK for clarity on taxable and non-taxable benefits. This ensures compliance with tax regulations and avoids inaccuracies in your calculations.

Final Gross Salary Calculation

In this example, your gross annual salary amounts to £60,900. This figure represents your total earnings before deductions and serves as the benchmark for understanding your compensation package.

Why Gross Salary Matters

Gross salary is more than a simple number on paper; it is a critical metric for financial planning and career development. It provides a clear picture of your earning potential, helping you compare job offers and negotiate better pay packages. Understanding gross salary also allows you to estimate your tax obligations and plan your monthly budget accordingly.

For employers, gross salary is an essential part of attracting and retaining talent. It reflects the total value they place on an employee’s contributions. For employees, gross salary plays a key role in determining financial goals, whether it’s saving for a major purchase, investing in education, or building a retirement fund. By understanding the components of gross salary, you’re better equipped to identify opportunities for financial growth and stability.

Conclusion

Gross salary is a vital aspect of your financial life. It encompasses the total earnings agreed upon with your employer before deductions and provides the foundation for understanding your true earning power. By breaking down its components and learning to calculate it, you gain valuable insights into your financial situation. This knowledge not only helps in managing current finances but also empowers you to negotiate better terms and plan effectively for the future.

Whether you’re evaluating a new job offer, renegotiating your pay, or setting financial goals, a thorough understanding of gross salary ensures you make informed decisions.