Understanding your annual income is one of the cornerstones of effective financial planning. This figure represents the total amount of money you earn over the course of a year, encompassing all sources of income before any deductions. Knowing your annual income is essential for managing your finances, setting achievable financial goals, and ensuring you’re prepared for expenses and investments. Whether you’re evaluating a job offer, planning for taxes, or applying for a loan, your annual income serves as a critical metric for making informed decisions.

What Is Annual Income?

Annual income refers to the total earnings accrued over a twelve-month period. It includes all sources of income, such as wages or salary from employment, freelance earnings, investment dividends, rental income, and any other financial inflows. For most individuals, this figure is broken down into two categories: gross annual income and net annual income. Gross income is the total earnings before deductions, while net income is what remains after taxes, social security, and other mandatory contributions are subtracted. For example, if you earn a salary of £30,000 from your primary job, an additional £5,000 from freelance work, and £2,000 in dividends, your gross annual income would amount to £37,000.

Having clarity on your annual income is crucial because it directly impacts your ability to budget effectively, qualify for financial products, and evaluate your overall financial health. Without this understanding, you might underestimate your tax obligations or overestimate your disposable income, leading to poor financial decisions.

Why Is Knowing Your Annual Income Important?

Being aware of your annual income is vital for several practical reasons. Firstly, it provides a foundation for creating a realistic budget. By understanding exactly how much you earn, you can allocate your income toward essential expenses, discretionary spending, savings, and investments. Secondly, when applying for a loan or mortgage, lenders use your annual income as a key metric to assess your creditworthiness and ability to repay. A higher annual income often translates to better loan terms and greater borrowing capacity.

In addition, knowing your annual income enables you to set and achieve financial goals. Whether you’re saving for a house deposit, planning a significant purchase, or building an emergency fund, an accurate understanding of your income helps you determine how much you can save each month. Lastly, it helps with tax planning. Understanding your annual income allows you to prepare for tax liabilities and identify opportunities for deductions or credits, ensuring you maximize your financial efficiency.

How to Calculate Your Annual Income

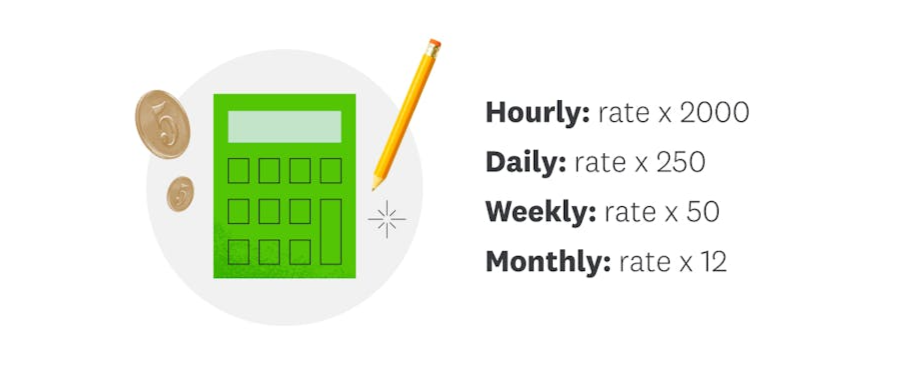

Calculating your annual income is a straightforward but essential process that ensures you have an accurate picture of your earnings. To begin, identify all sources of income over the past year. This includes your salary or wages, bonuses, overtime pay, freelance work, rental income, investment returns, and any other inflows of cash. For example, if you receive a monthly salary of £2,500, your annual salary from employment would amount to £30,000. If you earn an additional £10,000 from freelance projects and £5,000 in rental income, your total gross annual income would be £45,000.

Once you’ve calculated your gross annual income, you’ll need to account for deductions to determine your net annual income. Subtract taxes, pension contributions, social security payments, and any other deductions from your gross income. For instance, if your total deductions amount to £9,000, your net annual income would be £36,000. While online salary calculators can simplify this process, understanding how to perform the calculation manually ensures you are fully aware of how your income is distributed.

Applications of Annual Income Knowledge

Understanding your annual income has numerous applications in both personal and professional contexts. In personal finance, it allows you to create effective budgets and allocate your income wisely across needs, wants, and savings goals. It also helps you plan for significant life events, such as purchasing a home or funding education, by providing a clear picture of your financial capabilities.

In professional settings, knowing your annual income can be a powerful tool during salary negotiations. By understanding industry standards and comparing your income to peers, you can advocate for fair compensation. Furthermore, it ensures you have realistic expectations when evaluating job offers or planning career advancements. Employers also often request annual income figures to assess eligibility for certain benefits or performance incentives, making it critical to have an accurate and up-to-date understanding of this figure.

Conclusion

Your annual income is more than just a number; it’s a comprehensive reflection of your financial situation and a critical tool for planning your future. Whether gross or net, understanding this figure enables you to budget effectively, prepare for taxes, and make informed financial decisions. By calculating your total income accurately and using this knowledge wisely, you can take control of your finances, set realistic goals, and build a stable and prosperous future.