Understanding how salary paychecks work is essential for anyone in a salaried position. A salary paycheck is a regular payment an employee receives as compensation for their work, usually as part of an agreed-upon annual salary. The payment is distributed on a scheduled basis, such as monthly or bi-weekly, and often includes detailed information about earnings, deductions, and benefits. This system provides financial stability and predictability, which is invaluable for effective financial planning and budgeting.

How Salary Paychecks Are Structured

Salary paychecks are typically based on an employee’s gross annual salary, which is divided into equal portions and distributed over the payment periods throughout the year. For instance, if an employee earns £40,000 annually and is paid monthly, each paycheck will reflect one-twelfth of the gross salary, amounting to £3,333.33 before deductions.

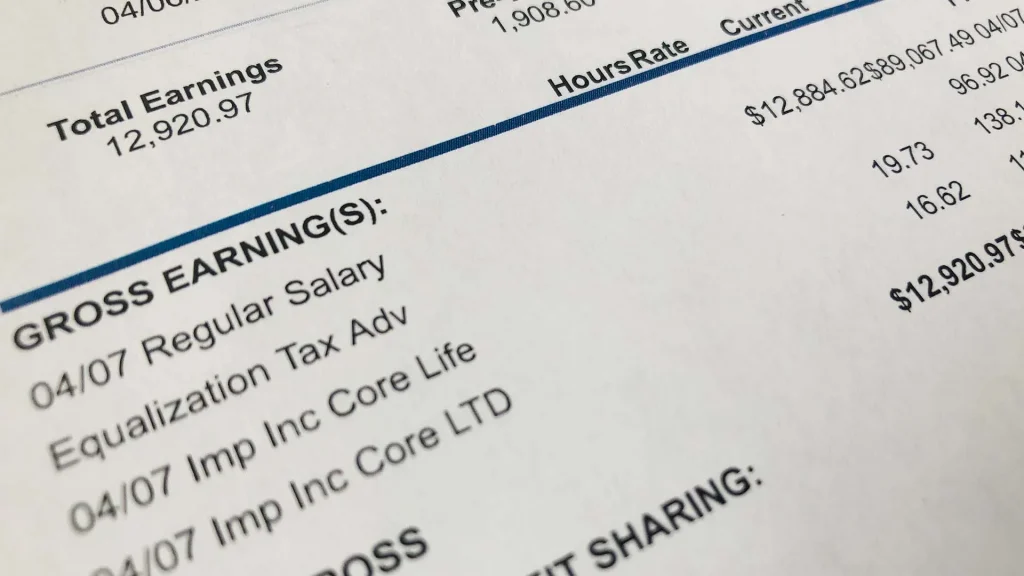

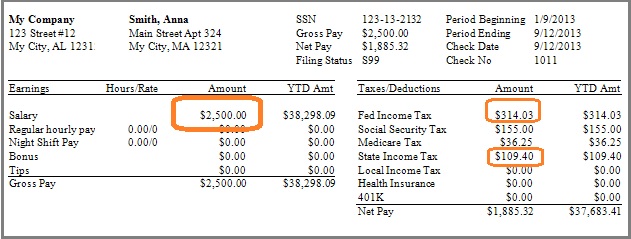

These paychecks include detailed breakdowns of income and deductions. The gross income section outlines the total earnings for that period, including base pay and any additional earnings such as bonuses or overtime (if applicable). The deductions section specifies amounts subtracted for taxes, National Insurance contributions, pensions, and any other agreed-upon reductions, such as health insurance or charitable donations. The resulting figure, known as the net income, is the amount deposited into the employee’s bank account.

How Often Are Salaries Paid?

The frequency of salary payments varies depending on the employer and industry standards. In the UK, most salaried employees are paid either monthly or bi-weekly. Monthly payments are the most common, with salaries typically disbursed on a specific date, such as the last working day of the month. Bi-weekly payments, while less common, are favored in certain industries and ensure employees receive paychecks every two weeks.

Some employers may also opt for weekly payments, particularly in industries like retail or hospitality. However, this arrangement is less common for salaried positions and is typically reserved for hourly or part-time workers. The payment schedule is usually outlined in the employment contract, ensuring clarity for both parties.

What Deductions Are Included in Paychecks?

Deductions play a significant role in determining the net amount of a salary paycheck. Common deductions include income tax, calculated based on an employee’s annual earnings and applicable tax brackets. In the UK, National Insurance contributions are another major deduction, funding social benefits such as healthcare and pensions. Pension contributions, whether to a workplace or private scheme, are also typically subtracted from gross income.

Additional deductions may include student loan repayments, health insurance premiums, and other voluntary contributions. For example, if an employee’s gross monthly salary is £3,333 and total deductions amount to £750, the net monthly salary would be £2,583. Understanding these deductions ensures employees can anticipate their take-home pay accurately and plan their finances accordingly.

Benefits of Salary Paychecks

Salary paychecks offer numerous advantages, the most significant of which is financial stability. Knowing exactly when and how much money will be received allows employees to manage recurring expenses, such as rent or mortgage payments, utility bills, and savings contributions. Additionally, the detailed breakdown provided in salary paychecks fosters transparency, enabling employees to track their earnings and understand their deductions.

Another benefit is the inclusion of additional compensation elements, such as bonuses or expense reimbursements, which are often itemized on the paycheck. This clarity helps employees see the full value of their compensation package and ensures they are aware of any discrepancies or errors.

Tips for Managing Salary Paychecks

Effectively managing salary paychecks involves understanding the full scope of earnings and deductions. Employees should carefully review their pay stubs each period to ensure accuracy and identify any inconsistencies. It’s also important to allocate a portion of each paycheck to savings or investments, building financial security for the future.

Using budgeting tools or apps can help track income and expenses, ensuring that spending remains within limits and financial goals are met. For employees with irregular deductions, such as fluctuating bonuses or commissions, maintaining a flexible budget can help adapt to changing income levels. Finally, staying informed about tax changes and benefits ensures employees maximize their earnings and avoid surprises during tax season.

Conclusion

Understanding how salary paychecks work and how often salaries are paid is a crucial aspect of financial literacy. By knowing the structure of paychecks, the frequency of payments, and the deductions involved, employees can better manage their finances and plan for the future. With careful attention to detail and proactive budgeting, salary paychecks can provide the foundation for long-term financial stability and success.