Adro: The Perfect Financial Companion for European Graduates Moving to the US

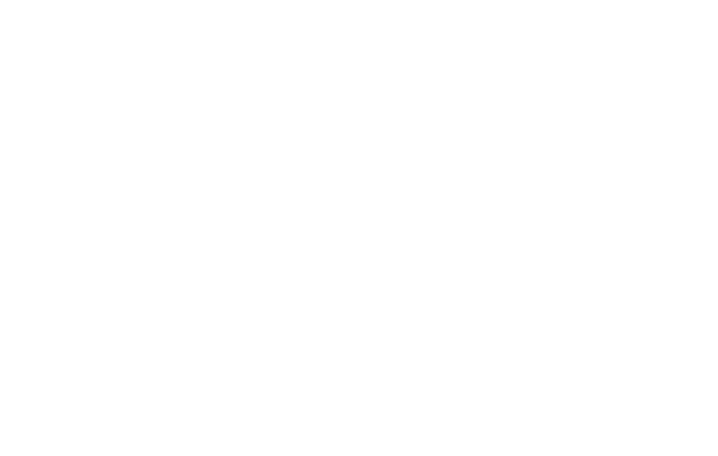

Navigating life in a new country comes with unique challenges, and managing your finances shouldn’t be one of them. For European graduates moving to the United States to kickstart their careers or pursue higher education, Adro offers a tailored solution to simplify financial transitions. Combining no-fee checking and savings accounts with a credit card designed specifically for internationals, Adro is redefining financial accessibility for newcomers to the U.S.

Moving to the U.S. often involves navigating a complex financial system, where traditional banking services may present hurdles for internationals. Many banks require in-person visits, U.S. addresses, or Social Security Numbers (SSNs) to open accounts. These barriers can delay access to essential financial tools such as checking accounts, debit cards, and credit-building opportunities. Adro eliminates these obstacles, providing a streamlined, digital-first banking experience that empowers users to focus on their personal and professional goals from day one.

In addition to its core financial offerings, Adro meets you where you’re at with a comprehensive app for both Apple and Android. From tracking transactions to accessing virtual cards—you can do it all with just a few taps. For European graduates, this means no more worrying about hidden fees, cumbersome setups, or limited financial mobility.

What Is Adro?

Adro is not just another financial service provider; it is a comprehensive solution designed to address the specific needs of international students and workers, especially those coming to the United States. By acting as a bridge between the financial systems of your home country and the U.S., Adro ensures that you can transition smoothly without unnecessary stress or complications.

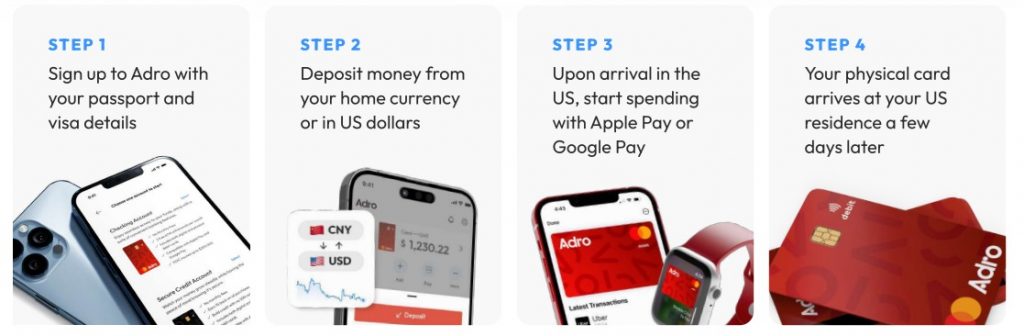

Unlike traditional banks that often impose barriers such as mandatory Social Security Numbers (SSNs), in-person visits, or U.S. residency requirements, Adro offers a fully digital, hassle-free approach. Whether you are still in Europe or have recently arrived in the U.S., you can open an account remotely with nothing more than your passport and address details. This flexibility makes Adro a standout choice for internationals.

Furthermore, Adro’s services are underpinned by Stearns Bank N.A., which provides FDIC insurance for your deposits up to $250,000. The FDIC insurance is specifically provided through Stearns Bank N.A., ensuring that your funds are safe. This partnership combines the innovation of a fintech company with the reliability and security of a traditional bank. Adro’s offerings—a no-fee checking account with a debit card, a savings account, and a secured credit card—cater specifically to individuals who need a head start in navigating the U.S. financial landscape while maintaining the convenience of digital-first tools.

Adro is a financial technology company that provides seamless banking solutions to international students and workers. Though not a traditional bank, Adro’s services are backed by Stearns Bank N.A., which ensures FDIC insurance up to $250,000 per account through Stearns Bank N.A. Its core products include a no-fee checking account with a debit card, a savings account, and a secured credit card—all designed with the unique needs of internationals in mind.

Why Choose Adro?

For graduates transitioning from Europe to the U.S., Adro offers several key advantages:

Easy Sign-Up Before or After Arrival

European graduates can open an account using their home or U.S. address, without needing a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). This allows them to prepare for their move by organizing finances in advance.

Example: Ana, a graduate from Spain moving to California for her first job, opened her Adro account while still in Madrid. She transferred funds from her Spanish bank to her new U.S. account, ensuring she had immediate access to dollars upon arrival, even before receiving her first paycheck.

No Hidden Fees

Adro’s accounts come with zero monthly fees, no minimum balance requirements, and no overdraft fees. Additionally, international wire transfers to Adro accounts incur no fees, and users enjoy two free ATM withdrawals per month from any network.

Example: Lukas, an engineer from Germany hired by a tech company in Seattle, saved significantly by avoiding traditional bank fees while moving his savings into U.S. dollars and using out-of-network ATMs near his temporary housing.

Building U.S. Credit History

Adro’s secured credit card, the Adro World Mastercard, allows users to build credit even before obtaining an SSN. With no interest rates or annual fees, it offers 1% cashback on every purchase while helping users establish a strong financial foundation in the U.S.

Example: Maria, a recent graduate from Italy pursuing her MBA in Boston, used her Adro credit card for everyday expenses like textbooks and groceries. By the time she received her SSN six months later, her established credit history helped her secure a lower interest rate on a car loan.

Proof of Funds Letter

Adro simplifies visa and customs processes by providing a downloadable proof of funds letter directly from the app. This is particularly useful for meeting entry requirements or supporting a visa application.

Flexible Spending Limits

With the Adro credit card, users can set their own spending limit based on the amount they deposit in their reserve account. This safeguards against overspending while providing flexibility for large purchases.

Example: Peter, a software developer from Poland, used his Adro credit card’s reserve account to manage his relocation expenses, such as purchasing a laptop and renting furniture. He appreciated the ability to adjust his spending limit without worrying about interest or late fees.

How Does Adro Compare?

Adro excels in areas where traditional banks fall short. Here is a quick comparison of Adro’s key features versus major U.S. banks:

| Feature | Adro | Chase | Bank of America | PNC | HSBC |

| Apply Outside the U.S. | Yes | No | No | No | Yes |

| No Monthly Fees | Yes | No | No | No | Yes |

| Google Pay/Apple Pay Ready | Yes | Yes | Yes | Yes | Yes |

| No Fees on Inbound Wires | Yes | $15 fee | $15 fee | $15 fee | Yes |

| Covered by FDIC | Yes (Stearns Bank, N.A) | Yes | Yes | Yes | Yes |

| No Overdraft Fees | Yes | $34 fee | $36 fee | $36 fee | Yes |

User-Friendly Features

Adro’s digital-first approach ensures that users can manage their accounts effortlessly:

- Instant Virtual Cards: Graduates can access their Adro debit or credit cards immediately via Google Pay or Apple Pay, making in-store and online purchases easy upon arrival in the U.S.

- Fast International Transfers: By transferring funds into their Adro accounts early, users mitigate currency fluctuations and receive bonuses for large deposits.

- Comprehensive App Functionality: The Adro app allows users to monitor balances, view transaction history, and access live chat support for a seamless banking experience.

- Integration with Cash App: Adro accounts and cards can be linked to Cash App, enabling quick peer-to-peer transfers for splitting rent or other shared expenses.

Adro’s Bonus Features

Adro offers more than just basic banking services. Graduates can benefit from:

- Bonuses on Large Transfers: For every $10,000 deposited into an Adro account, users receive a $50 bonus if the funds remain in the account for at least 90 days. This helps cover international transfer fees.

- Secure Banking Without Fees: Unlike traditional secured cards, Adro’s credit card does not require a deposit that is locked away. Instead, users can access and adjust their reserve funds as needed.

- Global Usability: Whether withdrawing cash at ATMs or making purchases internationally, Adro’s credit card incurs no foreign transaction fees.

The Adro Experience

For European graduates, Adro’s services eliminate the financial roadblocks often associated with moving to the U.S. Whether you’re enrolling in a graduate program or starting a new job, Adro offers a simple, reliable way to manage your money—from transferring funds and paying rent to building credit and planning for the future. With Adro, you can focus on thriving in your new environment rather than worrying about financial logistics.

By combining accessibility, no hidden fees, and credit-building tools, Adro positions itself as a vital resource for anyone transitioning to the United States.

Be one of the 10 lucky winners with Adro!

Dreaming of moving to the US or simplifying your finances abroad? Adro is launching a unique promotion for new users! Sign up by January 31st, open a free account, and deposit $500 to automatically enter the draw for amazing prizes: a flight, a new smartphone, or a cash reward.

Adro makes moving or managing finances as convenient as possible:

- Checking account with a debit card, savings account, or credit card.

- Account opening without SSN or ITIN.

- Zero international transaction fees and no fees for incoming wire transfers.

Participation details: https://help.joinadro.com/en/articles/10196741-offer-winter-2024-sweepstakes